Department Stores in Japan: All You Need to Know in 2026

How are Japan’s department stores different?

Japan is one of the few countries in the world where traditional department stores, usually huge, multi-merchandise category emporiums, still work and form an important part of the retail culture. They are led by names such as Isetan and Mitsukoshi, Takashimaya, Daimaru and Matsuzakaya, Sogo Seibu, Hankyu, and Kintetsu. Although these largest companies operate multiple stores, even within the same chain, individual stores often operate as separate companies, acting as subsidiaries of the larger parent.

These stores are quite different from a Nordstrom or JCPenney in the US. Each individual store is a key retail location in its own right, with its own set of tenants, services, and sometimes even merchandise profile. The majority are large, 20,000 sqm or bigger, and most sit on prime real estate, commanding high customer traffic. Mostly, these are premium retailers and prime locations for luxury brand boutiques, high-end food and restaurants, and a key channel for exclusive imported ranges. At the same time, the format is highly accessible, offering something for everyone, from sales of top brands of jewellery to regular ‘fairs’ celebrating products from particular parts of Japan or other countries – food fairs are a key promotional channel for most large trade commissions working in Japan.

As for early 2026, there are 180 department stores still operating in Japan, around 60 per cent of which are run by one of the five largest companies. Until 2024, there was at least one department store in each of Japan’s 47 prefectures, but now the format is absent from three.

Characteristics of Department Stores in Japan

Department stores are a very distinctive format in Japan but there are a several clear variations and some key defining characteristics:

Types of Department Store

There are two types of department store: city stores and regional stores, which largely relate to their locations as implied. City stores are located in one of Japan’s 10 largest cities, while regional stores operate outside these cities. The former are the larger, more successful stores with some properties still prosperous and growing, while the latter are generally in decline, but with some important exceptions. Today, as companies have become larger, the biggest chains have stores both in major cities and in some regional locations too.

History and Status

Department stores in Japan are often seen as some of the most presitiguous retailers available, with this prestige and status often, but not always, linked to company history. A handful of top stores trace their history back hundreds of years, and these are still stores that, through high-end merchandise and luxury brands, as well as premium locations, are still the places where consumers shop for status. A gift wrapped in department store paper is clearly more expensive and, for some, more presitiguous that one from a more modern chain store.

Matsuzakaya, for example, traces its origins back to 1611, first opening soon after the Tokugawa Shogunate came into power. Daimaru, Matsuzakaya’s sister company, is a newcomer in comparison, having been established as late as 1717, a mere 300 years ago. Isetan, Mitsukoshi, Sogo and Takashimaya also all trace histories back hundreds of years. Some surviving stores in regional cities also have long histories, such as Fujisaki in Sendai (1819) or Marui Imai in Sapporo (1872). By the early 1900s, department stores were the largest retailers in Japan, often selling through their own branches and through direct marketing across the whole country.

However, there is a second class of department store which developed much more recently. Most of these were established by major commuter rail operators, opening stores above major terminals to capture the massive customer traffic these terminals generate. There are fewer such companies but all of the larger, privately-owned commuter rail companies are today major retailers in their own right and most also run department stores. These include Seibu, Hankyu, Kintetsu, Tobu, Tokyu, and Meitetsu.

In 2000, Sogo became the first major Japanese retailler to fail since before the OPEC crisis of the early 1970s. Sogo was soon rehabilitated in partnership with another struggling department store to become Sogo Seibu, and after a brief period of ownership by Seven & I Holdings, was acquired by investment fund Fortress in 2023.

Sogo’s early demise was an important milestone as it marked it demonstrated how out of date much of department store retailing had become, with too many underperforming stores and no clear positioning. Since then, other major players have also merged, notably:

- J Front Retailing: formed in 2007, from the merger of Daimaru and Matsuzakaya

- H2O Retaling: formed in 2007, from the merger of Hankyu and Hanshin

- Isetan-Mitsukoshi: formed in 2008

Premium Emporiums

While some of the largest retailers in Japan up to the 1970s, and heavily protected by regulations that made it difficult to open new stores larger than 1,500 sqm, Japan’s retail market began to shift with the development of chain store retailing. Modern, city-located department stores have evolved over the past five decades to position themselves as true luxury emporiums, serving high end customers.

For the leading companies, large parts of their total sales, sometimes as much as 70%, is derived from VIP customer databases, called ‘Gaisho’ (外商) in Japanese. Weathy families who spend large amount with a particular store each year are catered to through personal shopping assistants, VIP lounges, access to private sales events, and numerous other perks – some companies arrange shopping tours for their most exclusive customers. Department stores are also major beneficiaries of Japan’s recent tourist boom.

Food Basements (デパ地下)

A key feature of most department stores is their food basements. Almost all stores operate one or sometimes multiple basement floors offering various food foods. Most space is run by tenant vendors, with a variety of products from packaged foods, through extensive deli and fresh foods, to wide ranges of imported brands. A lot of this is exclusive and high-end, of course, but depachika are also popular among commuters who will visit on their way home in the evening to pick up treats for the evening meal.

Leading Department Store Retailers by Sales

Department stores have declined from Japan’s largest retail format in the 1970s, with major companies accounting for most of the top 10 firms until the late 1990s. Those days are now long gone. Although the top companies now have established themselves as luxury retailers for brands, food, jewellery, and cosmetics, the format is unlikely to regain the volume it once had.

The convenience store sector is one of the most concentrated retail sectors in Japan. Despite its large size, only three companies dominate, with roughly 90% of both sales and stores.

Major players in the Japanese Department Store Sector

Isetan-Mitsukoshi Holdings

Formed in 2008 through a merger between Isetan (1886) and Mitsukoshi (its roots dating to 1673 as Echigoya), Isetan-Mitsukoshi owns some of the most prominent flagship department stores in the country, including Isetan Shinjuku, Mitsukoshi Nihonbashi and Mitsukoshi Ginza. The group has recently enjoyed strong profitability improvements, with FY2024 department store operating income up around 30% and margins above 5%, driven by cost reforms and high-spending core customers. Nine-month results to December 2025 showed slightly lower net sales due to a pullback in duty-free sales to tourists, notably a fall-off in Chinese visitor numbers, but a record quarterly operating profit, supported by domestic demand. Distinctive strengths include fashion leadership at Isetan Shinjuku, a large identified customer base of about 7.6 million, and a premium urban store network, including some in key regional cities.

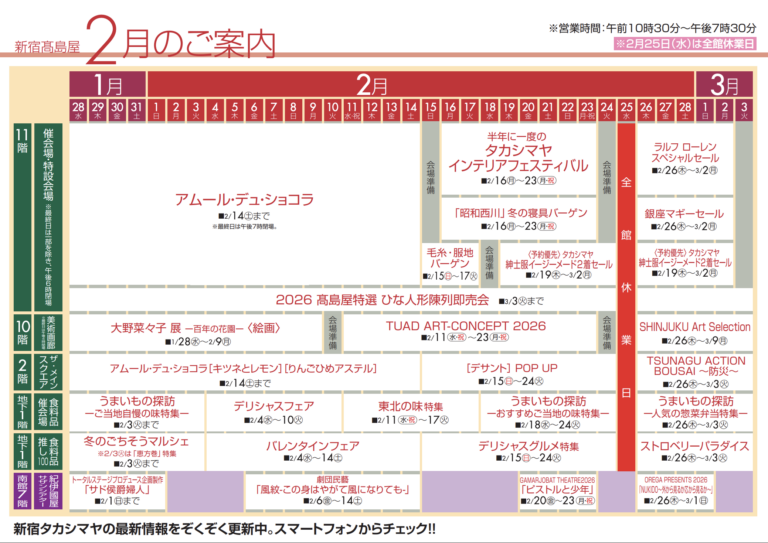

Takashimaya

Takashimaya traces its origins to a Kyoto drapery shop founded in 1831 and became a modern department store pioneer in the early twentieth century, adopting fixed prices and display-led merchandising. It operates a national network anchored by stores in Tokyo’s Nihonbashi and Osaka’s Namba, as well as overseas flagships in Singapore, Bangkok, and Ho Chi Minh City. It combines department-store retail with real estate and finance. In the nine months to November 2025, consolidated operating revenue fell 2.2% year-on-year to about JPY 354 billion, while operating profit declined 10.3%. Annual revenue has recovered since the pandemic, reaching roughly JPY 498.5 billion in 2025, with inbound demand and domestic luxury consumption as key drivers. In Japan, Takashimaya is distinguished by its strong real estate-backed “Takashimaya Times Square” and SC-style complexes, a long-running overseas presence, and a relatively conservative yet stable brand image among major chains.

H2O Retailing

Hankyu’s department store business originated in the early 20th century under the railway operator Hankyu, which pioneered the integrated “terminal department store” model at Umeda in Osaka. Hanshin, run by a rival commuter rail company that also operates out of Umeda, later opened a competing store nearby, and the two groups were eventually merged into Hankyu Hanshin Holdings and H2O Retailing in 2007. Hankyu Umeda is a top-tier fashion and luxury flagship for Kansai, while the one Hanshin store is known for food halls and everyday appeal. Both benefit from heavy commuter flows. Recent Hankyu Hanshin Group results show rising operating revenue and business profit in FY2024, aided by recovering transport and hotel operations and strong sports-related demand following the Hanshin Tigers’ championship win. Department store sales growth has been modest but positive, with Hankyu posting a 0.6% year-on-year increase in February 2025. Within the Japanese market, Hankyu-Hanshin stands out for its dense Osaka terminal footprint, strong fashion curation at Hankyu, and sports-driven brand power tied to the Tigers and Koshien heritage.

JapanConsuming Snapshot Report

Japanese Department Stores in 2025-26

Japanese Department Stores 2025-26 offers a quick but complete review of the department store sector, including future trends, strategies of leading operators, and rankings of the top firms and stores.

The report provides a snapshot update on the latest trends in Japanese department store retailing. These include the emergence of a new elite group of operators and stores with high levels of growth in both sales and profit, details of record sales exceeding the 1980s heyday, and new types of supply, including more direct sourcing

With Japanese Department Stores, you will be able to quickly understand who the new leaders are, where the sector is heading and where the opportunities are, whether as a supplier, competitor or investor.

All reports are available to Enterprise subscribers of JapanConsuming.

Buy our annual Convenience Store Report today

Table of Contents:

- Executive Summary

- It’s all about accessories

- Only the top few have surpassed 2019 sales

- Widening performance gap

- Top 30 department store operators

- A tale of two formats: Top 50 stores

- Tourists visit but don’t spend

List of Charts:

- Department Store Sales by Category, FY2024-5

- Top Stores by Apparel And Fashion Accessory Sales. FY2024-5

- Big City Stores vs Regional Stores, 2007-2024

- Leading Department Store Companies. FY2024-5

- Leading Department Store Branches. FY2024-5

- Tourist sales at department stores, 2022 to July 2025

Author:

Roy Larke is an academic and researcher. He co-founded JapanConsuming.com in 2000 and has worked in Japan for most of the past 30 years, researching Japanese retail and consumer markets.